The growing number of public schools that require students to pay a fee to participate in after school activities, such as sports or music, is exacerbating the economic class disparities in America’s schools, and diminishing opportunities for students from families of limited financial means.

“Play to play must end,” said social scientist Robert Putnam, a professor of public policy at Harvard University, and author of the best-selling book Our Kids: The American Dream in Crisis, appearing in Hartford in a special event sponsored by the Hartford Foundation for Public Giving.

Putnam, who rose to cultural prominence in 2000 with his book “Bowling Alone: The Collapse and Revival of the American Community,” mixed riveting stories of the vastly different life experiences of the nation’s children, depending upon the financial wherewithal of their parents, and the dangers to every aspect of society - rich and poor - of permitting the growing disparities to continue unchecked.

According to his data, 86 percent of students from the highest-income families participate in extracurricular activities — slightly higher than during the 1970s — but participation among the lowest-income families is down about 15 percentage points, to 65 percent.

“No one talked (50 years ago) about soft skills, but voters and school administrators understood that football, chorus, and the debate club taught valuable lessons that should be open to all kids, regardless of their family background,” Putnam writes in the book.

Pay to play policies have been evident in Connecticut, as elsewhere across the country, for some time, as reflected in data compiled by the state Office of Legislative Research (OLR) in 2012. The OLR report included information from 116 school districts. Of these, “44 charged a participation fee for high school athletics. The fees range from $25 per sport to $1,450 for ice hockey. Twenty nine school districts include a maximum amount that a student, family, or both can be charged during a single school year. Schools without a cap are generally those that charge the lowest fees.”

Following that report, legislation that would have prohibited local and regional boards of education from charging any student activity fees to students who are unable to pay such fees was considered in 2013 but not approved by the state legislature.

Last month, education officials in Norwalk proposed requiring student athletes to pay $100 each to participate athletic programs. Published reports indicated that students who participate in high school musicals in the city pay about $200 as a participation fee.

Putnam noted that although many school districts that charge such fees provide for waivers for financial need, those tend not to be used because students would rather drop a sport than be stigmatized as poor and needy. And he emphasized that dropping out of participation in after school activities worsens development and lessens chances to break away from a life of diminished opportunities. The absence of such extra-curricular participation adversely impacts both future circumstances and physiological developmental, Putnam said.

The OLR data indicated that in Trumbull, for example, a family could pay as much as $750 (or $900 including hockey) for students’ participation in sports; in South Windsor the payment was capped at $500 per family, or $800 including hockey. In Region 10, which includes the towns of Burlington and Harwinton, there was a maximum of $450 per family for participation in sports.

The Connecticut Interscholastic Athletic Conference Handbook for 2016-17 includes reference to the organization’s “strong opposition to the local board of education policies which establish a fee system for students who wish to participate in co-curricular or extra-curricular activities, athletic and/or non-athletic.”

The Connecticut Interscholastic Athletic Conference Handbook for 2016-17 includes reference to the organization’s “strong opposition to the local board of education policies which establish a fee system for students who wish to participate in co-curricular or extra-curricular activities, athletic and/or non-athletic.”

Among the organizational policy positions included in the handbook, the Administrators of Health and Physical Education “feel a direct assessment on the individual families of athletes is contrary to the educational philosophy so deeply rooted in our nation, and is wrong because it places an undue tax on selected members of the community.”

“Athletics as an extra-curricular activity is unique in that it provides a possible predictor of student success in later life; and affords adolescent boys and girls an opportunity to establish a physical and social identity along with the intellectual identity they develop while in the classroom,” the Administrators of Health and Physical Education policy statement says.

The handbook section on “pay to play” continues, indicating that “In support of that notion is a pair of studies conducted by the American Testing Service and College Entrance Examining Board. The former completed a study comparing four factors thought to be possible predictors of student success: achievement in extracurricular activities, high grades in high school, and high grades in college as well as high scores on the SAT. It was found that the only factor which could be validly used to predict success in later life was achievement in extra-curricular activities.”

Adds the Connecticut Association of Public School Superintendents: “Free public education includes the student’s right to participate in activities offered by a school district. The student should not be denied participation because of lack of funds or the refusal to pay a fee.”

Putnam, speaking at the Bushnell Center for the Performing Arts to a nearly filled Belding Theater audience, recalled attending Yale University in Connecticut, and speaking in Hartford 16 years ago, when Bowling Alone was published. He stressed that there are fewer mixed-income neighborhoods than there were 50 years ago, and as a result children are less likely to go to school with people of a different social class.

The top third of US society – whether defined by education or income – are investing more in family life, community networks and civic activities than their parents, while the bottom third are in retreat, as families fracture and both adults and children disengage from mainstream society, he pointed out. That is evident in a range of statistics, he said, proceeding to share a series of graphs and charts that underscored his thesis.

Putnam identified causes of the widening opportunity gap for the current generation of young people as the collapse of the working class family, a substantial increase in single-parent homes among the poor, economic insecurity among growing cadre of working class people, and a cultural change of people no longer looking out for other people’s kids in a way that happened in the past. The definition of “our kids,” he said, has narrowed for a community’s children, to the biological children of individual families.

This gap amounts, Putnam emphasizes, is a “crisis” for the American dream of equal opportunity. Advantages pile up for the kids born to the right parents, all but guaranteeing their own success in life – in stark contrast to the fates of those struggling at the bottom.

Among the statistics of concern raised by Putnam: affluent children with low high-school test scores are as likely to get a college degree (30%) as high-scoring kids from poor families (29%). And he called for a focus less on the costs of community college and more on helping students unfamiliar with the bureaucracy and processes of college work their way through it. “We need navigators to help these students navigate the process,” he said, making a comparison to health care, where newly diagnosed cancer patients, unfamiliar with the world they have just entered, increasingly have “health care navigators” assigned to them as guides to deal with the uncertainty they face.

Despite the preponderance of evidence showing stark disparities, Putnam says he is optimistic that the trends can be reversed. “American did it once before, after the turn of the last century,” he explains, and can do so again. He suggests that the remedy will more likely be driven from the grassroots, in individual communities, than from policies adopted by the federal government.

The same measure showed the age 20-34 demographic group, at 0.22 percent, was considerably below the rate for other age groups. (This rate means that 221 out of every 100,000 adults in this age group became entrepreneurs in a given month.) The data also indicates that the rate of new entrepreneurs for the age 20-34 group is down from the high point for this age group of 0.28 percent in 1996.

The same measure showed the age 20-34 demographic group, at 0.22 percent, was considerably below the rate for other age groups. (This rate means that 221 out of every 100,000 adults in this age group became entrepreneurs in a given month.) The data also indicates that the rate of new entrepreneurs for the age 20-34 group is down from the high point for this age group of 0.28 percent in 1996.

The Connecticut Interscholastic Athletic Conference

The Connecticut Interscholastic Athletic Conference

The site said of

The site said of  s, including:

s, including: Funding for the competition prize awards will be provided both by the State of Connecticut, which has committed $1 million, and an additional $2 million commitment from private partners. The Doris Duke Charitable Foundation, The Kresge Foundation, Living Cities, NeighborWorks America, The United Illuminating Company, Stanley Black & Decker, Boehringer Ingelheim, Travelers Companies, Inc., The Hartford Foundation for Public Giving, Webster Bank, Eversource Energy, Liberty Bank Foundation, Hartford HealthCare, Barnes Group, Hoffman BMW of Watertown/Hoffman Auto Group, United Technologies Corp., Charter Communications, and Fairfield County’s Community Foundation have all committed to participating in the challenge.

Funding for the competition prize awards will be provided both by the State of Connecticut, which has committed $1 million, and an additional $2 million commitment from private partners. The Doris Duke Charitable Foundation, The Kresge Foundation, Living Cities, NeighborWorks America, The United Illuminating Company, Stanley Black & Decker, Boehringer Ingelheim, Travelers Companies, Inc., The Hartford Foundation for Public Giving, Webster Bank, Eversource Energy, Liberty Bank Foundation, Hartford HealthCare, Barnes Group, Hoffman BMW of Watertown/Hoffman Auto Group, United Technologies Corp., Charter Communications, and Fairfield County’s Community Foundation have all committed to participating in the challenge. “We are pleased to bring the Working Cities Challenge to Connecticut and are thankful to Governor Malloy for his support of the effort, as well as the Hartford Foundation, the Doris Duke Foundation, Living Cities, The Kresge Foundation, and many others,” Boston Fed President Eric Rosengren said. “The partners have come together to make it possible to bring the competition to Connecticut – precisely the model of cross-sector collaboration that forms the basis of the Working Cities Challenge. This competition focuses on the residents of the state’s postindustrial cities – places with unique assets that taken together can help to build civic leadership infrastructure, which our research shows is a key component of economic resurgence.”

“We are pleased to bring the Working Cities Challenge to Connecticut and are thankful to Governor Malloy for his support of the effort, as well as the Hartford Foundation, the Doris Duke Foundation, Living Cities, The Kresge Foundation, and many others,” Boston Fed President Eric Rosengren said. “The partners have come together to make it possible to bring the competition to Connecticut – precisely the model of cross-sector collaboration that forms the basis of the Working Cities Challenge. This competition focuses on the residents of the state’s postindustrial cities – places with unique assets that taken together can help to build civic leadership infrastructure, which our research shows is a key component of economic resurgence.” “It’s gratifying to see the strong support from Connecticut companies, foundations, and the Malloy administration for the Working Cities Challenge under the thoughtful leadership of the Boston Fed,” James C. Smith, Chairman and CEO of Webster Bank, said. “By encouraging the development of civic infrastructure as a prerequisite to physical infrastructure, the Working Cities Challenge promises to revitalize Connecticut’s smaller cities economically and transform the lives of inner city residents.”

“It’s gratifying to see the strong support from Connecticut companies, foundations, and the Malloy administration for the Working Cities Challenge under the thoughtful leadership of the Boston Fed,” James C. Smith, Chairman and CEO of Webster Bank, said. “By encouraging the development of civic infrastructure as a prerequisite to physical infrastructure, the Working Cities Challenge promises to revitalize Connecticut’s smaller cities economically and transform the lives of inner city residents.”

A recent report in Business Insider indicated that one in three new businesses in the U.S. were started by an entrepreneur age 50 or older. Describing “running a business as the new retirement,” the news report cited an infographic in easylifecover that highlighted those aged 55-64 in the U.S. have actually had the highest rate of entrepreneurial activity in the last 10 years, noting that the founders of McDonald's, Coca Cola, and Kentucky Fried Chicken – among others - were all over 50 when they established their businesses.

A recent report in Business Insider indicated that one in three new businesses in the U.S. were started by an entrepreneur age 50 or older. Describing “running a business as the new retirement,” the news report cited an infographic in easylifecover that highlighted those aged 55-64 in the U.S. have actually had the highest rate of entrepreneurial activity in the last 10 years, noting that the founders of McDonald's, Coca Cola, and Kentucky Fried Chicken – among others - were all over 50 when they established their businesses. The interactive “Boot Camp” event at reSET – open to people of all ages with a special focus on the 50 and over –included short presentations from local resource organizations, networking opportunities and valuable information on the programs and tools available to potential business owners. Attendees were updated on the necessary steps and tools to launch a business, and had opportunities to talk one-on-one with local mentoring organizations, lenders, small business advisors and community leaders for advice and assistance.

The interactive “Boot Camp” event at reSET – open to people of all ages with a special focus on the 50 and over –included short presentations from local resource organizations, networking opportunities and valuable information on the programs and tools available to potential business owners. Attendees were updated on the necessary steps and tools to launch a business, and had opportunities to talk one-on-one with local mentoring organizations, lenders, small business advisors and community leaders for advice and assistance. hand at the reSET event in mid-June were representatives of the Office of Secretary of State (where new businesses are registered),

hand at the reSET event in mid-June were representatives of the Office of Secretary of State (where new businesses are registered),  reSET serves all entrepreneurs, but specializes in social enterprise ― impact driven business with a double and sometimes triple bottom line. In addition to providing co-working space and accelerator and mentoring programs, reSET aims to inspire innovation and community collaboration, and to support entrepreneurs in creating market-based solutions to community challenges. The organization’s goal is to “meet entrepreneurs wherever they are in their trajectory and to help them take their businesses to the next level.”

reSET serves all entrepreneurs, but specializes in social enterprise ― impact driven business with a double and sometimes triple bottom line. In addition to providing co-working space and accelerator and mentoring programs, reSET aims to inspire innovation and community collaboration, and to support entrepreneurs in creating market-based solutions to community challenges. The organization’s goal is to “meet entrepreneurs wherever they are in their trajectory and to help them take their businesses to the next level.”

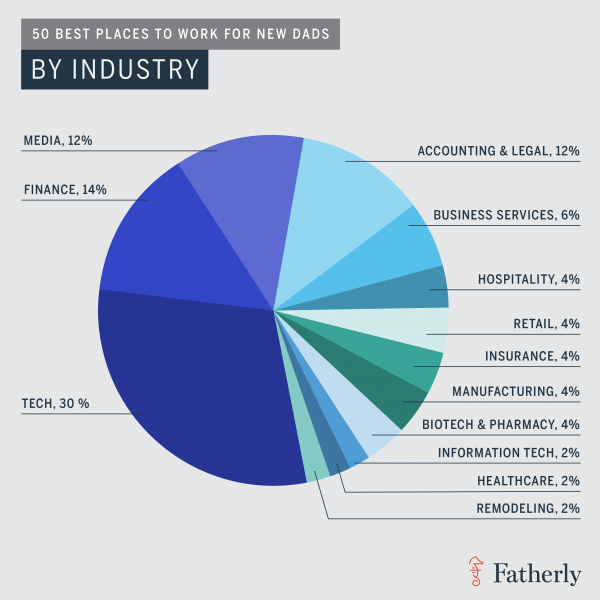

Among the nation’s top businesses for new dad, an analysis by the website Fatherly, determined that two Connecticut-based companies – alcoholic beverages producer Diageo and financial data and analysis provider FactSet, earned slots in the top 50. Fatherly is a digital lifestyle guide for men entering parenthood.

Among the nation’s top businesses for new dad, an analysis by the website Fatherly, determined that two Connecticut-based companies – alcoholic beverages producer Diageo and financial data and analysis provider FactSet, earned slots in the top 50. Fatherly is a digital lifestyle guide for men entering parenthood. were Netflix, Spotify, Facebook, Patagonia, Bank of America, Pinterest, Google, Microsoft, Twitter, Airbnb, Johnson & Johnson, Accenture, MasterCard, Intuit and Intel.

were Netflix, Spotify, Facebook, Patagonia, Bank of America, Pinterest, Google, Microsoft, Twitter, Airbnb, Johnson & Johnson, Accenture, MasterCard, Intuit and Intel.

tion into one composite indicator of entrepreneurial business growth.”

tion into one composite indicator of entrepreneurial business growth.”

The quarterly survey is released by

The quarterly survey is released by