They may be disbanded, but they’re sticking together – driven by a belief that the state’s future hangs in the balance.

The Connecticut Commission on Fiscal Stability and Economic Growth, a panel of primarily state business leaders appointed by the state legislature and Governor last year to help the state grapple with its ongoing fiscal challenges, went out of existence on March 1 when they issued a comprehensive 119-page report following three months of public hearings and deliberations.

Nonetheless, the 14 members, mostly prominent business leaders, continue to seek opportunities to discuss their recommendations in public forums, regularly advocate for substantial changes in the management of state fiscal affairs, have begun meeting with gubernatorial candidates, and are urging business leaders across the state to keep up the pressure on state elected officials to take comprehensive action consistent with their wide-ranging recommendations.

“We committed to see it through,” said Commission co-chair Jim Smith, Chairman and former CEO of Webster Bank. “We knew it wouldn’t be one (legislative session) and done. This is about policy, not politics. We’ve all checked our politics at the door. This is about the greater good, and how we change the course of Connecticut’s future.”

With all 187 legislative seats and the six state’s statewide constitutional offices – including Governor - up for election this November, the Commission co-chairs believe Connecticut’s best opportunity for much-needed systemic structural changes will be in the next legislative session, which begins in January. They intend to “actively engage” throughout this election season and in next year’s legislative session, and have already met with about half of the current field of gubernatorial candidates.

Smith and Robert Patricelli, former CEO & Founder of Women's Health USA, who co-chaired the panel, were featured along with Commission member Cindi Bigelow, CEO of Bigelow Tea, at an event coordinated by the Hartford Business Journal last week. It was one of nearly 100 forums, discussions and one-on-one meetings that the co-chairs and other commission members have had since their findings and recommendations were issued.

Smith and Robert Patricelli, former CEO & Founder of Women's Health USA, who co-chaired the panel, were featured along with Commission member Cindi Bigelow, CEO of Bigelow Tea, at an event coordinated by the Hartford Business Journal last week. It was one of nearly 100 forums, discussions and one-on-one meetings that the co-chairs and other commission members have had since their findings and recommendations were issued.

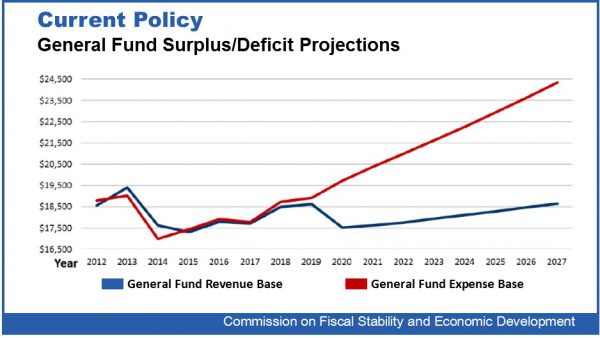

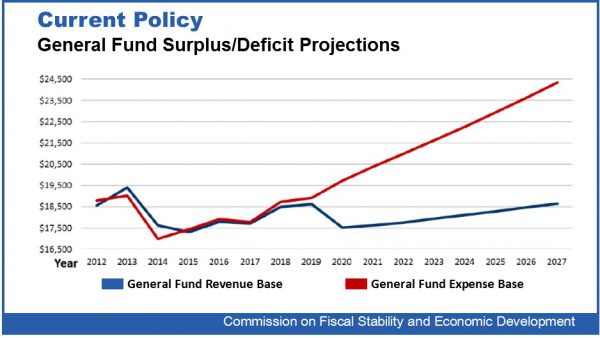

The Commission uses the analogy of a “burning platform” to describe the current budgetary process, fiscal structure and economic status of the state, a frame of reference that reflects the public’s concern about the state’s precarious standing. Smith said he is encouraged by the response they’re receiving.

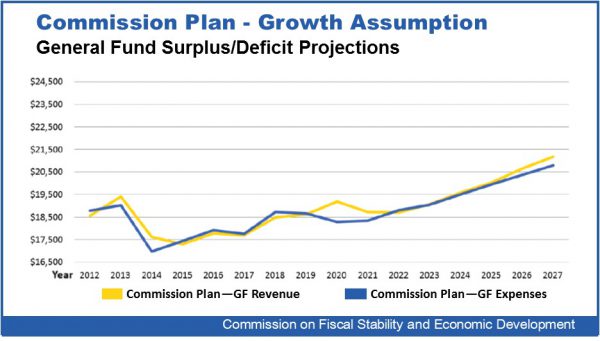

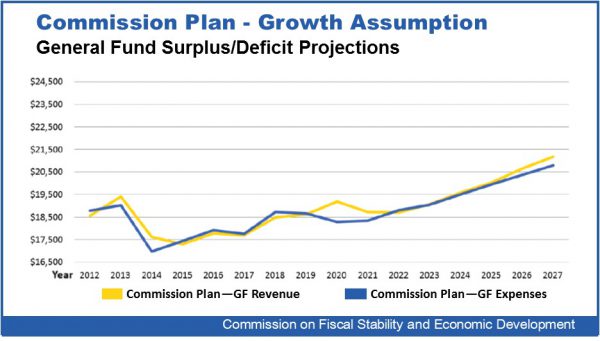

“When we talk about the platform burning, people are riveted. They’re anxious to hear solutions,” Smith explains, noting that the approaches proposed by the Commission are resonating with audiences because they provide a comprehensive – if challenging – path to douse the flames and stimulate economic growth, achieve sustainable budgets long-term, and re-establish the state’s competitiveness.

“Our findings are irrefutable, inescapable and require action,” Smith told CT by the Numbers. “That comes across loud and clear.”

The Commission leaders are committed to generating a spirited public conversation about their findings and recommendations. They told an attentive audience in Hartford last week that the 14 members remain in communication, and have now been working longer since they ceased to exist as a Commission than during the 76 days that they were officially constituted by law. And they have no plans to walk away from the work they began.

In underscoring their commitment to remain involved beyond the life of the Commission, the co-chairs have evoked the memorable phrase from the 1976 movie Network – they’re mad as hell and they’re not going to take this anymore. In fact, their goal remains to do something about it. Pursuing a public conversation and meeting privately with leading gubernatorial candidates are parts of the strategy.

Smith indicates that as the Commission’s work unfolded, members were concerned that the “platform was even hotter than we knew,” but encouraged that creation of the Commission reflected a willingness to involve the private sector in charting the path forward.

Patricelli, in fact, has floated the idea of having 500 businesses to sign a letter to the state’s elected officials urging action on the Commission’s recommendations, which include changes in spending, tax policy, investments, infrastructure, transportation and competitiveness. Only with sustained pressure, he argues, will the incoming legislature and Governor take action. They point to the sustained drop in Connecticut’s Gross State Product (9.1% over the past decade), while the state’s New England and Tri-State neighbors saw growth, as among the numerous factors that led to their conclusion that substantial changes are needed in the state’s fiscal policies.

The co-chairs say it is understandable that more was not done with the Commission’s recommendations during the short 2018 legislative session, largely because an election was just around the corner. Instead, the legislature opted to have the Office of Policy and Management (OPM) coordinate two studies, soon to get underway. One would look at the Commission’s recommendations that involve “rebalancing of state taxes to better stimulate economic growth without raising net new taxes”; the other would conduct a study of the proposal for reform of the Teachers' Retirement System.

The co-chairs say it is understandable that more was not done with the Commission’s recommendations during the short 2018 legislative session, largely because an election was just around the corner. Instead, the legislature opted to have the Office of Policy and Management (OPM) coordinate two studies, soon to get underway. One would look at the Commission’s recommendations that involve “rebalancing of state taxes to better stimulate economic growth without raising net new taxes”; the other would conduct a study of the proposal for reform of the Teachers' Retirement System.

The legislature also voted to have OPM issue a request for proposals to hire a national consultant to study and make recommendations regarding efficiency improvements in revenue collection and agency expense management that will result in a savings of at least 500 million dollars.

Each is a potential step forward, but not nearly enough, the co-chairs have indicated since the session ended on May 9. Some aspects of the Commission’s work is evident in those actions, and the timing of those efforts, to be ready in January as newly elected officials take office, may provide pieces to build on.

Patricelli has also suggested that the state’s part-time legislature is not up to the task of governing a 21st century state, by its very nature. The legislature is in session for 5 months in even-numbered years and 3 months in odd-numbered years, in accordance with the state constitution. That’s just not enough, he says, suggesting that a comprehensive study be done on the legislative systems in other states to determine what might be best for Connecticut.

In addition to Smith, Patricelli, and Bigelow, Commission members were Pat Widlitz (Vice-Chair), former state representative from Guilford and Co-Chair of the General Assembly’s Joint Committee on Finance, Revenue and Bonding; Jim Loree, President and CEO of Stanley Black & Decker; Chris Swift, Chairman and CEO of The Hartford; Bruce Alexander, Vice President of State Affairs and Campus Development at Yale University; Greg Butler, Executive Vice President and General Counsel of Eversource Energy; Roxanne Coady, Founder and CEO of R.J. Julia Booksellers; David Jimenez, Partner at Jackson & Lewis and a member of the state Board of Regents for Higher Education; Paul Mounds, Vice President for policy at the Connecticut Health Foundation; Frank Alvarado, Veterans Affairs Officer, Small Business Administration; Eneas Freyre, New York Life and Michael Barbaro, President, Connecticut Realtors.

Rounding out the top ten are Virginia ($7,161), New Jersey ($7,151), Maryland ($7,043), Hawaii ($6,981), D.C. ($6,963), Texas ($6,902), Colorado ($6,718), and Georgia (6,675). New York is next at $6,671.

Rounding out the top ten are Virginia ($7,161), New Jersey ($7,151), Maryland ($7,043), Hawaii ($6,981), D.C. ($6,963), Texas ($6,902), Colorado ($6,718), and Georgia (6,675). New York is next at $6,671.

The analysis, by the financial services website WalletHub, was based on 40 key indicators of livability, ranging from housing costs to school-system quality to restaurants per capita. The indicators were grouped into five categories – affordability, economic health, education & health, safety, and quality of life.

The analysis, by the financial services website WalletHub, was based on 40 key indicators of livability, ranging from housing costs to school-system quality to restaurants per capita. The indicators were grouped into five categories – affordability, economic health, education & health, safety, and quality of life.

The comprehensive assessment of Hartford’s ecosystem also noted that “Hartford’s [startup] founders claim to have the right ambition to go global,” concluding that “Hartford’s startups have more potential to strengthen Global Market Reach and Global Connectedness.” In a number of areas analyzed in the assessment, Hartford is seen as having potential to strengthen the local startup community, its reach beyond Hartford, and the demographic of startup teams.

The comprehensive assessment of Hartford’s ecosystem also noted that “Hartford’s [startup] founders claim to have the right ambition to go global,” concluding that “Hartford’s startups have more potential to strengthen Global Market Reach and Global Connectedness.” In a number of areas analyzed in the assessment, Hartford is seen as having potential to strengthen the local startup community, its reach beyond Hartford, and the demographic of startup teams.

“I am delighted the city has joined Sustainable CT in our latest efforts to develop and implement sustainability and renewable energy initiatives in Norwalk,” said Mayor Harry Rilling. “Being energy conscience is the right thing to do as we all have a moral obligation to lessen our environmental impact. I am glad the city has taken a leadership role and joined this important sustainability initiative.” Norwalk’s Council approved the resolution to join Sustainable CT in mid-August and designated the Common Council Planning Committee as the “Sustainability Team” for the program. Norwalk was officially registered with Sustainable CT on August 24.

“I am delighted the city has joined Sustainable CT in our latest efforts to develop and implement sustainability and renewable energy initiatives in Norwalk,” said Mayor Harry Rilling. “Being energy conscience is the right thing to do as we all have a moral obligation to lessen our environmental impact. I am glad the city has taken a leadership role and joined this important sustainability initiative.” Norwalk’s Council approved the resolution to join Sustainable CT in mid-August and designated the Common Council Planning Committee as the “Sustainability Team” for the program. Norwalk was officially registered with Sustainable CT on August 24.

American Innovation $1 coins, to be issued at a rate of four new coins per year, will bear a reverse image or images emblematic of a significant innovation, an innovator, or a group of innovators from each of the 50 states, the District of Columbia, and the territories of the United States. Published reports indicate that the $1 coins would sell for more than face value — up to $1.32 — providing a healthy profit for the federal government since the coins cost less than 35 cents to make.

American Innovation $1 coins, to be issued at a rate of four new coins per year, will bear a reverse image or images emblematic of a significant innovation, an innovator, or a group of innovators from each of the 50 states, the District of Columbia, and the territories of the United States. Published reports indicate that the $1 coins would sell for more than face value — up to $1.32 — providing a healthy profit for the federal government since the coins cost less than 35 cents to make.

The review of the research, conducted by Connecticut-based Rodriguez Data Solutions, points out that policymakers often promote K-12 regionalization as a way to achieve cost savings, but often fail to consider the consequences for student educational achievement. The report reviewed initiatives to promote K-12 regionalization in several states including Connecticut, Maine, New York and Vermont. Among the findings:

The review of the research, conducted by Connecticut-based Rodriguez Data Solutions, points out that policymakers often promote K-12 regionalization as a way to achieve cost savings, but often fail to consider the consequences for student educational achievement. The report reviewed initiatives to promote K-12 regionalization in several states including Connecticut, Maine, New York and Vermont. Among the findings:

Smith and Robert Patricelli, former CEO & Founder of Women's Health USA, who co-chaired the panel, were featured along with Commission member Cindi Bigelow, CEO of Bigelow Tea, at an event coordinated by the Hartford Business Journal last week. It was one of nearly 100 forums, discussions and one-on-one meetings that the co-chairs and other commission members have had since their findings and recommendations were issued.

Smith and Robert Patricelli, former CEO & Founder of Women's Health USA, who co-chaired the panel, were featured along with Commission member Cindi Bigelow, CEO of Bigelow Tea, at an event coordinated by the Hartford Business Journal last week. It was one of nearly 100 forums, discussions and one-on-one meetings that the co-chairs and other commission members have had since their findings and recommendations were issued.

The co-chairs say it is understandable that more was not done with the Commission’s recommendations during the short 2018 legislative session, largely because an election was just around the corner. Instead, the legislature opted to have the Office of Policy and Management (OPM) coordinate two studies, soon to get underway. One would look at the Commission’s recommendations that involve “rebalancing of state taxes to better stimulate economic growth without raising net new taxes”; the other would conduct a study of the proposal for reform of the Teachers' Retirement System.

The co-chairs say it is understandable that more was not done with the Commission’s recommendations during the short 2018 legislative session, largely because an election was just around the corner. Instead, the legislature opted to have the Office of Policy and Management (OPM) coordinate two studies, soon to get underway. One would look at the Commission’s recommendations that involve “rebalancing of state taxes to better stimulate economic growth without raising net new taxes”; the other would conduct a study of the proposal for reform of the Teachers' Retirement System.