Cigna Looks to Invest in Start-up Insurance Ventures, Establishes $250 Million Fund

/Health services organization Cigna has launched Cigna Ventures, a corporate venture fund with an infusion of $250 million in capital to be invested in healthcare technology startups and early-stage companies.

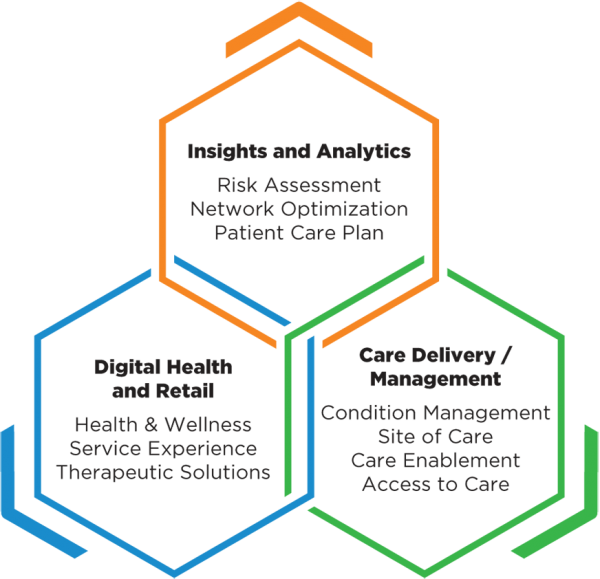

Cigna has committed $250 million of capital to Cigna Ventures, according to officials, to invest in promising startups and growth-stage companies that are unlocking new growth possibilities in health care and will bring improved care quality, affordability, choice, and greater simplicity to customers and clients. Cigna Ventures is focused on companies across three strategic areas: insights and analytics; digital health and retail; and care delivery/management.

“Cigna’s commitment to improving the health, well-being and sense of security of the people we serve is at the front and center of everything we do,” said Tom Richards, senior vice president and global lead, strategy and business development at Cigna. “The venture fund will enable us to drive innovation beyond our existing core business operations, and incubate new ideas, opportunities and relationships that have the potential for long-term business growth and to help our customers.”

Cigna Ventures was created to help Cigna identify, assess and sponsor early-stage innovation ideas that warrant deeper exploration through focused pilot and test-and-learn activities with the goal of realizing meaningful business value. The initiative’s newly launched website suggests that “Cigna Ventures is the strategic corporate venture capital partner of choice in the health care industry. We work closely with entrepreneurs to accelerate growth and innovation through strategic use of capital and deep partnerships.”

Companies in the portfolio, according to published reports, include Omada Health, a digital therapeutics company treating chronic diseases; Prognos, a predictive analytics company for healthcare; Contessa Health, a home-patient care service; Mdlive, which provides remote health consultations; and Cricket Health, a special kidney care provider.

Companies in the portfolio, according to published reports, include Omada Health, a digital therapeutics company treating chronic diseases; Prognos, a predictive analytics company for healthcare; Contessa Health, a home-patient care service; Mdlive, which provides remote health consultations; and Cricket Health, a special kidney care provider.

CIGNA’s interest in the rapidly-evolving health care field is also reflected in the company’s membership, presence, and investment in insurance technology start-ups at Upward Hartford, the co-working and innovation center in Hartford that was the site of the city’s inaugural Insurtech Hub earlier this year, and is now home to the winning participants in Hartford’s first annual insurance accelerator, held in April.

Amidst the start-ups are a number of Hartford’s longstanding insurance giants, including Cigna.

Bloomberg reported last week that overall investment in health-care startups has increased this year. According to the MoneyTree Report from PricewaterhouseCoopers and CB Insights, $10.6 billion was invested in health-care deals in the first half of this year. Two of the seven largest venture-capital rounds in the second quarter involved health-care firms, the report shows.

“Our partnership with Cigna has been about so much more than capital,” said Sean Duffy, co-founder and CEO of Omada. “The ability to collaborate with, learn from, and integrate deeply with a health services company so dedicated to delivering a 21st-century care experience to its customers and clients has enabled us to accelerate innovation, advance our capabilities, and grow our customer base.”

Cigna Corporation and Express Scripts received approval this week from the Antitrust Division of the United States Department of Justice for their pending $50 billion plus merger, which is expected to close by year’s end. “Quality health care and competitive pricing for health care services and pharmaceutical drugs is critical to U.S. consumers,” said Makan Delrahim, the head of the antitrust division, in a statement announcing approval of the deal.