Health Care Costs Climbing in Connecticut, Outpacing National Average, Inflation, Household Income

/“The rapid growth in healthcare costs over the last few decades has placed a profound burden on families and businesses.”

That’s the opening sentence in the Connecticut Office of Health Strategy’s Cost Growth Benchmark Initiative report, issued last month highlighting numbers that reflect rising costs and suggest their widespread adverse impact.

From 2000 to 2020, the report states on its introductory page, setting the tone for the data and analysis that follows. “Per person spending on healthcare in Connecticut grew at an average rate of 4.8% per year, compromising residents’ ability to afford critical healthcare services and other basic needs.”

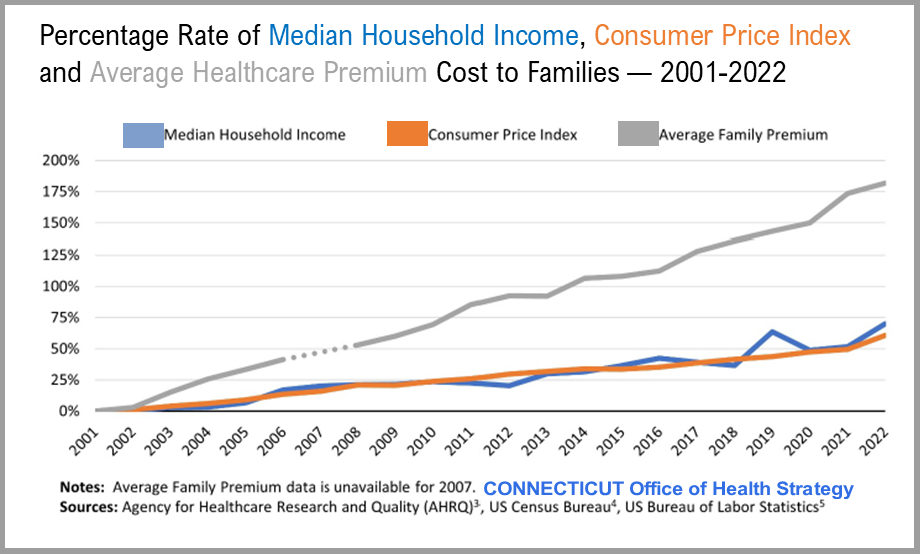

“The average family premium for employer-sponsored coverage, through which more than half of Connecticut residents receive their healthcare coverage, nearly tripled over the last two decades,” rising from $8,781 in 2001 to $24,746 in 2022, the most recent year analyzed by the Office. “By contrast,” the report continues, the “consumer price index (i.e. inflation) grew 61% and median household income grew 70% during that timeframe.”

“With premiums rising faster than incomes, families have to spend a larger portion of their income on healthcare coverage,” the report points out, explaining that “the average family deductible increased over 350% from $898 in 2002 to $4,053 by 2022, more than quadrupling over two decades.”

Hospital inpatient prices, the report indicates, are both higher than many other comparable areas in New England and “far beyond” the national median. As examples, the report states that in 2021, hospital inpatient prices in Hartford were 27% greater, New Haven 42% greater, and Bridgeport 43% greater than the national median. In comparison, Boston, Massachusetts, and Providence, Rhode Island, were 9% and 10% respectively above the national median, the report states.

“High healthcare costs disproportionately affect marginalized racial and social groups,” the report points out, “making them more susceptible to financial distress and compelling them to adopt cost-cutting measures, such as delaying care, more often.”

The 49-page report also highlights growth in state spending on healthcare, and breaks down spending related to pharmacy and other healthcare services.

For example, the report states that a 2022 survey of Connecticut residents found that “23% of respondents had cut pills in half, skipped doses of medicine, or did not fill a prescription due to costs. The implications for health disparities are severe: people of color, those with at least one member with a disability in their household, and those with low incomes were more likely to modify or skip their prescription.”

The report’s analysis suggests that “n the pursuit of more affordable healthcare, prescription drugs present a crucial opportunity to curb healthcare spending growth.”

Overall, the report concludes that “policymakers now know where healthcare spending goes, how much it increases, and whether payments or service volume is the primary driver.” Additionally, it praises the increased transparency in tracking costs to state residents, but warns that “transparency alone, however, will not solve the problem of affordability for Connecticut residents.”