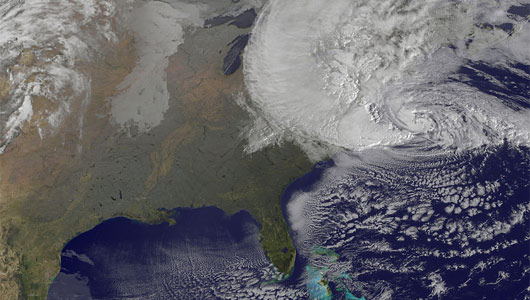

Hurricane Sandy: 3rd Costliest Insured Loss Catastrophe Worldwide Since 1970

/Hurricane Sandy, which hit Connecticut and the Northeast in October 2012, produced the 3rd costliest insured loss in the past 43 years, according to data compiled by Swiss Re and reported by Bloomberg.

Half of the 15 costliest catastrophes since 1970 have occurred in the past 10 years. The analysis methodology, going back to 1970, reviewed loss including property and business interruption, excluding liability and life insurance losses. It was released this week by Bloomberg Businessweek.

Half of the 15 costliest catastrophes since 1970 have occurred in the past 10 years. The analysis methodology, going back to 1970, reviewed loss including property and business interruption, excluding liability and life insurance losses. It was released this week by Bloomberg Businessweek.

Hurricane Sandy was reported to have an insured loss of $36.9 billion. The Federal Emergency Management Agency has reported that although New England was spared the brunt of the storm, residents and businesses along the shores of Connecticut, Rhode Island, Massachusetts and New Hampshire suffered severe damages from wind and water, many losing homes and livelihoods. New York and New Jersey were also hard-hit by the record-setting storm, which disrupted livelihoods, transportation and electricity grids and countless industries.

The top ranked insured lost was Hurricane Katrina, which catastrophically hit the Gulf Coast in August 2005, which losses estimated at $80.3 billion. Next costliest was the earthquake which triggered a tsunami in Japan in March 2011, with an insured loss of $37.6 billion. All loss amounts were indexed to 2013, for purposes of comparison.

Rounding out the top five costliest insured losses of nearly the past half-century were Hurricane Andrew, which hit Florida, neighboring states and the Bahamas in August 1992, with an insured loss of $27.6 billion and the terrorist attack on the World Trade Cen ter and the Pentagon on September 11, 2001, with insured losses of $25.6 billion.

ter and the Pentagon on September 11, 2001, with insured losses of $25.6 billion.

Also ranked in the top 10 were the Northridge, California earthquake in 1994, Hurricane Ike in 2008, Hurricane Ivan in 2004, flooding in Thailand in 2011, and a New Zealand earthquake in 2011.

A September 2013 report by the U.S. Department of Commerce Economics and Statistics Administration had estimated that the total payout by the insurance industry related to Hurricane Sandy was expected to be reduced because much of the storm damage was caused by the storm surge and subsequent flooding was not covered by standard homeowner or small business commercial policies. Also, reportedly half of all losses of the insurance industry were expected to be covered by reinsurers. The report indicated that the Insurance Information Institute estimated that insurers would pay $18.75 to $25 billion to over 1.5 million policyholders across 15 states including Connecticut, and the District of Columbia. More than two-thirds of claims were anticipated from homeowners, with the highest value of claims from commercial property owners ($9 billion)accounting for almost half of the value of claims paid, the report indicated.

The insurance industry had its third-most expensive year on record in 2012, led by Hurricane Sandy, with global economic losses from natural catastrophes and man-made disasters totaling $186 billion, according to a previous report issued by Swiss Re.