Percentage of Unbanked, Underbanked Households Continues to Climb in CT, Now Exceeds 1 in 5 Households

/One in five Connecticut households is unbanked or underbanked, according to data compiled by the Federal Deposit Insurance Corporation, and the percentage of residents unbanked – those that do not have an account at an insured institution - has climbed in the state over the past six years.

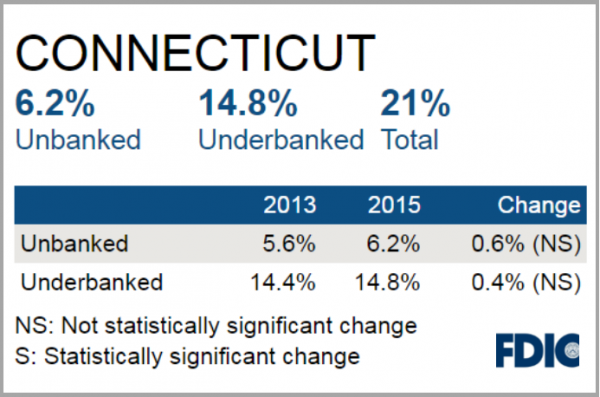

The percentage of Connecticut households considered unbanked has risen steadily, from 5.3 percent in 2009 to 6.2 percent in 2015, the most recent year for which data is available. Connecticut ranked 21st in the nation in the percentage of unbanked households.

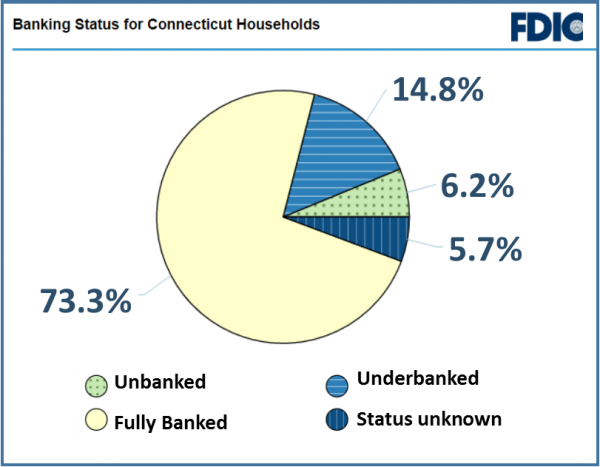

Overall, the percentage of state households thatare either unbanked or underbanked increased slightly, from 20 percent to 21 percent between 2013 and 2015. Those considered unbanked had a checking or savings account but also obtained financial products and services outside of the banking system.

Connecticut’s percentage of unbanked and underbanked individuals is better than the national average, which is 26.9 percent. Nationally, 68 percent are considered to be fully banked, with an account or accounts at an insured institution, compared with 73.3 percent in Connecticut.

To assess the inclusiveness of the nation’s banking system, and in partial fulfillment of a statutory responsibility, the FDIC conducts biennial surveys of households to estimate the proportion of households that do not fully participate in the banking system. The survey provides estimates of the proportion of U.S. households that do not have an account at an insured institution, and the proportion that have an account but obtained (nonbank) alternative financial services in the past 12 months.

Estimates from the 2015 survey indicate that 7.0 percent of households in the United States were unbanked in 2015. This proportion represents approximately 9.0 million households. An additional 19.9 percent of U.S. households (24.5 million) were underbanked,

The 2015 FDIC National Survey of Unbanked and Underbanked Households presents new data and insights on the size of unbanked and underbanked markets at the national, regional, state, and large metropolitan statistical area (MSA) levels. This is the fourth installment of the report.

In the Hartford-East Hartford-West Hartford metropolitan statistical area, a slightly higher percentage of households are unbanked or underbanked – 25.6 percent. In the New Haven-Milford MSA, that percentage is slightly lower than statewide, at 19.5 percent. The Bridgeport-Stamford-Norwalk MSA is lower still, at 18 percent.