Connecticut Receives "F" in Report Card on High School Financial Literacy Requirements

/

Connecticut received a resounding F in a state-by-state Report Card of financial literacy education requirements at the high school level, according to a study by the Center for Financial Literacy at Champlain College in Burlington, Vermont.

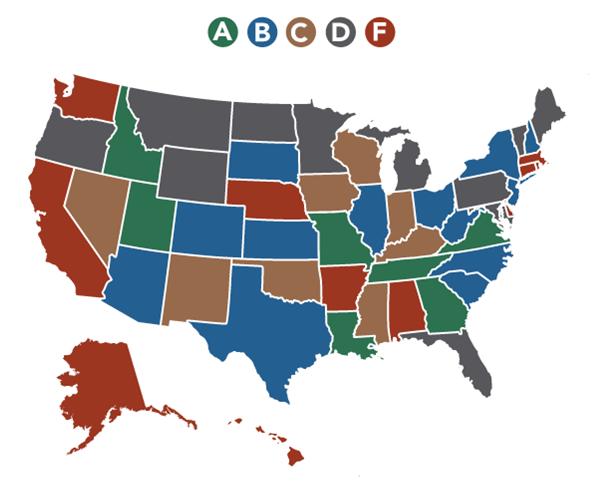

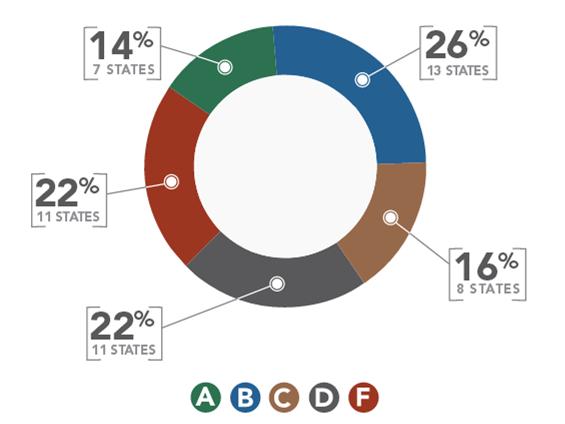

Connecticut is one of 11 states to receive a failing grade. The others were Alabama, Alaska, Arkansas, California, Delaware, Hawaii, Massachusetts, Nebraska, Rhode Island and Washington. Those states, according to the report, “have few requirements, or none at all, for personal finance education in high school.”

Overall, 60 percent of states received a C, D or F while 40 percent of states received an A or B grade. Among those at the head of the class, receiving an A, were Georgia, Idaho, Louisiana, Missouri, Tennessee, Utah and Virginia. Four of those states – Virginia, Utah, Tennessee and Missouri – require a one-semester standalone course in personal finance as a graduation requirement.

Overall, 60 percent of states received a C, D or F while 40 percent of states received an A or B grade. Among those at the head of the class, receiving an A, were Georgia, Idaho, Louisiana, Missouri, Tennessee, Utah and Virginia. Four of those states – Virginia, Utah, Tennessee and Missouri – require a one-semester standalone course in personal finance as a graduation requirement.

The report, 2013 National Report Card on State Efforts to Improve Financial Literacy in High Schools, indicated that in Connecticut:

- Personal finance topics are included in the state’s educational guidelines but the state does not require that local school districts teach these topics. (Source: CEE Survey)

- No personal finance requirement, although personal finance may be taught at certain schools as an elective. (Source: Jump$tart Survey)

- Since 2007 Connecticut legislators have introduced seven bills in an attempt to bring financial literacy into their schools. All attempts have failed. In 2009 the state passed a law allowing banks to open branches in schools to help students learn about saving money. (Source: NCSL Summaries)

The report suggests four key elements to a successful financial literacy program at the high school level:

- Requirement: Financial literacy topics must be taught in a course that students are required to take as a graduation requirement.

- Training: Teacher training is critical. To effectively educate our students about personal finance, we need confident, well-trained educators.

- Funding: Funding is needed to ensure that these classes are offered to all high school students.

- Assessed: In order to make sure that the high school classroom personal finance training is working, we need to give students standards assessments on knowledge and behaviors.

Noting the lack of financial literacy education across the country, the report indicates that “for our nation’s youth, learning is often being down through personal experience. Making mistakes with your credit is a painful way to learn a life lesson.” The report’s introduction also notes that “to improve personal finance outcome for American citizens, our nation must be educated in personal finance… In too many of our states, our youth receive little if any personal finance training in middle school, high school and college.”