Personal Financial Literacy Education Lacking in CT Schools

/Only five states require a stand-along course in Personal Finance for high school graduation. Connecticut is not one of them. With a statewide requirement unlikely, students in at least one town are trying to take matters into their own hands by advocating for financial literacy to be a graduation requirement.

In West Hartford, a student-driven petition has amassed about 600 signatures, The Hartford Courant reported recently. For the class to be required, the town’s Board of Education would need to approve it.

Two national reports highlight the lack of a requirement for financial literacy in order to graduate high school. Fundamental knowledge, such as how to manage a checkbook and the impact of interest on outstanding loans or credit card purchases are staples of personal finance courses when they are offered. Some schools in Connecticut offer such classes, but only a small percentage of students tend to take them, because they are not required.

One national report said of Connecticut, “personal finance is not included in the graduation requirements either as a stand-alone course or embedded in another course. And personal finance is not required to be offered or taken.”

Another national analysis noted the following:

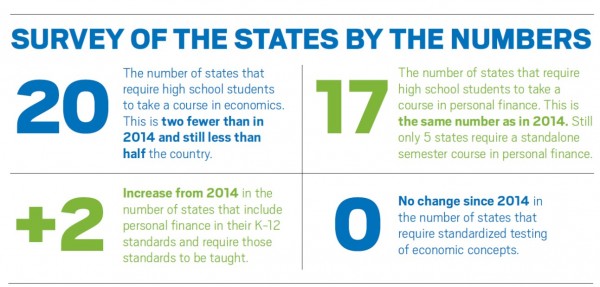

- Since 2014, two additional states include personal finance in their K-12 standards and require those standards to be taught.

- While more states are implementing standards in personal finance, the number of states that require high school students to take a course in personal finance remains unchanged since 2014 – just 17 states.

- Only 20 states require high school students to take a course in economics – that’s less than half the country and two fewer states than in 2014.

- There has been no change in the number of states that require standardized testing of economic concepts – the number remains at 16.

- 75 percent of credit card carrying college students were unaware of late payment charges.

Connecticut’s Social Studies Framework, adopted a year ago, includes economics, economic decision-making, exchange and markets, the national economy and the global economy among “supporting disciplines” among the main concepts for world history instruction in grades 9-12.

Personal financial literacy, however, is not included.

The 2016 Survey of the States by the Council for Economic Education (CEE) shows that there has been slow growth in personal finance education in recent years and no improvement in economic education.

Every two years, CEE conduct s a comprehensive look into the state of K-12 economic and financial education in the United States, collecting data from all 50 states and the District of Columbia. The biennial Survey of the States serves as an important benchmark, revealing “both how far we’ve come and how far we still have to go.” This year the report concluded that nationally “the pace of change has slowed.”

s a comprehensive look into the state of K-12 economic and financial education in the United States, collecting data from all 50 states and the District of Columbia. The biennial Survey of the States serves as an important benchmark, revealing “both how far we’ve come and how far we still have to go.” This year the report concluded that nationally “the pace of change has slowed.”

Connecticut state Sen. L. Scott Frantz has tried unsuccessfully to improve financial education in Connecticut for seven of the past eight years with proposed legislation that would require it, the CT Post reported recently. This year, due to a strong focus on the state budget, he’s been told introducing the bill again would be moot, so will wait until next year to broach the topic again, the Post reported.

“You have generations of kids graduating without a clue about managing their personal finances,” Frantz said. “It doesn’t have to be anything more sophisticated than how to balance a checkbook, understanding a credit card and interest rates, being aware of the marketing tactics that credit card institutions use. It’s an area that we need to improve upon significantly going forward.”

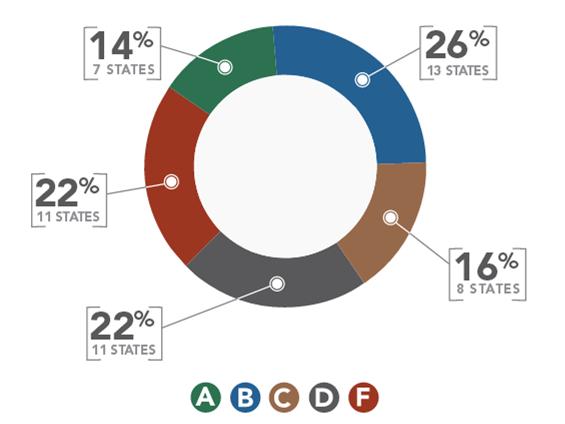

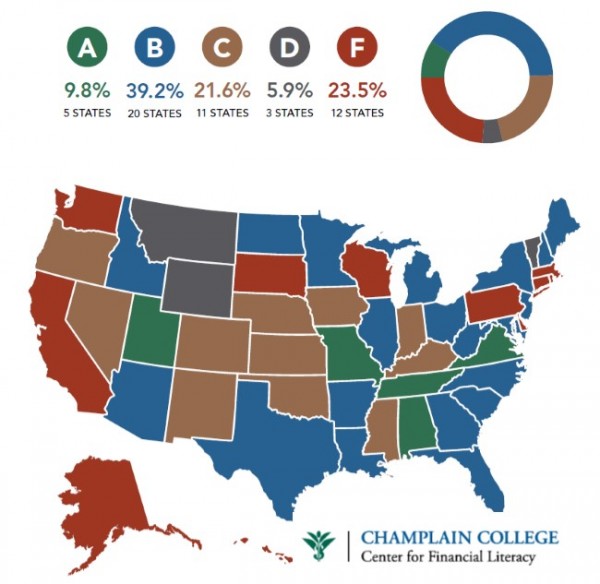

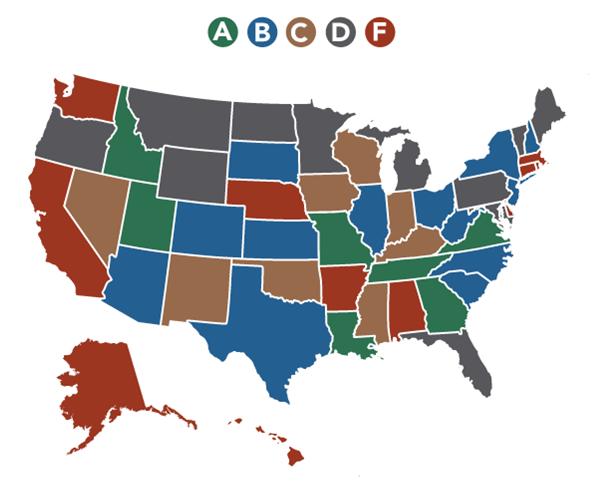

Champlain College's Center for Financial Literacy, using national data, graded all 50 states and the District of Columbia (D.C.) in 2015 on their efforts to produce financially literate high school graduates. In their review, 26 states received grades of C, D or F. Less than half were given grades A or B, and 29% had grades of D or F. Connecticut was among those earning an F.

Of the states with failing grades, the analysis said: These states have few requirements or none at all for personal finance education in high school. High school students in these states are able to graduate without ever having the opportunity to take a course that includes financial literacy instruction. The report noted that California, Connecticut, Massachusetts, Pennsylvania, Washington and Wisconsin have created programs that promote financial literacy education in high schools. However, this support does not eliminate the possibility of a student leaving high school without access to any financial literacy instruction prior to graduation.

“States that combine personal finance and economics, support teachers, and hold stude nts accountable for learning objectives have the best chance of promoting the development of young people who are better financial managers and stewards of their credit—behaviors with which many, if not most, young people tend to struggle,” said J. Michael Collins of the University of Wisconsin-Madison’s Center for Financial Security. “Rigorous state standards can facilitate local schools to implement well-designed programs, which in turn expose students to concepts they otherwise would not learn.”

nts accountable for learning objectives have the best chance of promoting the development of young people who are better financial managers and stewards of their credit—behaviors with which many, if not most, young people tend to struggle,” said J. Michael Collins of the University of Wisconsin-Madison’s Center for Financial Security. “Rigorous state standards can facilitate local schools to implement well-designed programs, which in turn expose students to concepts they otherwise would not learn.”

Overall, 60 percent of states received a C, D or F while 40 percent of states received an A or B grade. Among those at the head of the class, receiving an A, were Georgia, Idaho, Louisiana, Missouri, Tennessee, Utah and Virginia. Four of those states – Virginia, Utah, Tennessee and Missouri – require a one-semester standalone course in personal finance as a graduation requirement.

Overall, 60 percent of states received a C, D or F while 40 percent of states received an A or B grade. Among those at the head of the class, receiving an A, were Georgia, Idaho, Louisiana, Missouri, Tennessee, Utah and Virginia. Four of those states – Virginia, Utah, Tennessee and Missouri – require a one-semester standalone course in personal finance as a graduation requirement.