Credit Card Debt Increases Among Older Residents

/As Connecticut struggles to lift itself from a nagging recession and rebuild a shaky economy and grow jobs, new national data suggest that economic realities plus an aging population are combining to increase the credit card debt among a significant segment of the population. It has been estimated that the state's 65+ population would increase by 69 percent between 2000 and 2030. Middle-income Americans age 50 and older are carrying more credit card debt on average than younger people, according to a National Survey on Credit Card Debt of Low- and Middle-Income Households, released last month by Demos, a national policy think tank and AARP’s Public Policy Institute.

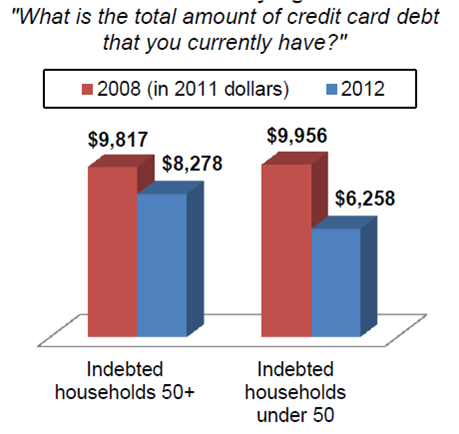

The results of the 2012 survey are a reversal of findings from a survey conducted by Demos in 2008. It reveals a troubling picture of middle-income 50+ households carrying card debt near or in their retirement years.

The report shows that nationwide, older households carried an average credit card balance of $8,278 in 2012. For those under 50, credit card debt averaged $6,258. Other key findings for middle-income households that carried credit card debt for three months or more:

50, credit card debt averaged $6,258. Other key findings for middle-income households that carried credit card debt for three months or more:

- A third of older households used credit cards to pay for basic living expenses such as rent, mortgage payments, groceries, or utilities.

- Half of Americans age 50+ carried medical expenses on their credit cards. Prescription drugs and dental expenses were the main contributors.

- A quarter of older households said loss of a job contributed to their credit card debt in the last three years.

- Nearly one in five (18 percent) older Americans nearing retirement said they dipped into retirement funds to pay down credit card debt.

- Older Americans were twice as likely as those under age 50 to take on credit card debt to assist other family members (23 percent vs. 11 percent).

This report suggests that credit card debt among older Americans is primarily a reflection of difficult economic times, not a lack of personal financial responsibility. State-by-state data was not available.

The findings may help to explain the economic challenges facing Connecticut’s citizenry, which is on track to becoming one of the oldest among the states, expected to grow from 470,183 (13.8% of the total state population) in 2000 to 794,405 in 2030, constituting 21.5% of the projected total state population.