Rich Towns in CT Have 8 Times the Resources of Poor Towns to Pay for Municipal Services, Study Finds

/The most resource-rich towns in Connecticut had, on average, a per capita revenue capacity that was more than eight times the average of the most resource-poor communities’ capacity. That conclusion, highlighted in a study by the Federal Reserve Bank of Boston, which pointed to “large non-school fiscal disparities across cities and towns in Connecticut.”

“These disparities are driven primarily by differences in revenue-raising capacity,” the report, “Measuring Municipal Fiscal Disparities in Connecticut,” concluded. “Because municipalities in Connecticut rely almost exclusively on property taxes for own-source revenue, this is directly tied to the uneven distribution of the property tax base.”

The study, issued in May, “found that municipal costs are driven by five key factors outside the control of local officials: the unemployment rate, population density, private-sector wages, miles of locally maintained roads, and the number of jobs located within a community relative to its resident population.” Fiscal disparities exist when some municipalities face higher costs for providing a given level of public services or fewer taxable resources to finance those services than others, according the report synopsis.

The study explains that “in Connecticut, municipalities provide a range of services including education, public safety, public works, human services, and general government. While educational fiscal disparities—and the effectiveness of the state’s Education Cost Sharing (ECS) grant in addressing them—have received considerable attention in Connecticut, less is known about how municipalities’ underlying characteristics affect their ability to provide other vital public services and the degree to which state policies ameliorate differences.”

The highest-cost group of communities had average per capita municipal costs that were 1.3 times the average per capita costs of the lowest-cost group of cities and towns, the study found, noting that “variation in measured capacity stems from differences in resources, not choices about tax rates. In Connecticut, real and personal property taxes are virtually the only source of revenue that cities and towns are authorized to levy.”

Breaking down the state’s geography, the report indicated that “the highest capacity areas (darkest shades on the map) are located in the southwestern and northwestern corners of the state, and along the shoreline. Connecticut’s lowest-capacity municipalities (the lightest shades on the map) are mostly scattered through the central and eastern portions of the state. In general, communities in northeastern Connecticut also tend to have fairly low per capita revenue capacity.”

The municipal gap data highlighted in the report is described as “the difference between the uncontrollable costs associated with providing public services and the economic resources available to a municipality to pay for those services.” To calculate the per capita “gap” for each community, the study subtracted per capita revenue capacity from per capita cost for each municipality:

- Thus, a “positive gap” indicates a municipality that lacks sufficient revenue-raising capacity to provide a given common level of municipal services, with larger gaps indicating a worse fiscal condition.

- By contrast, a negative gap represents a municipality that has more than enough revenue-raising capacity to provide this common level of municipal services.

The study found “a wide range of municipal gaps among Connecticut’s 169 communities, indicating significant fiscal disparities across the state.” Although cost differences play a role, “these gaps are largely driven by the uneven distribution of revenue capacity across the state. This, in turn, is the direct result of the uneven distribution of the property tax base.”

- The report indicated that “a total of 78 Connecticut municipalities had a positive fiscal gap, meaning there was insufficient revenue raising capacity, representing 46 percent of the state’s communities (and close to 60 percent of the state’s population).

- The state’s remaining 91 communities had a negative fiscal gap (more than sufficient revenue-raising capacity) in the year studied, FY2011.

The state’s cities, with the notable exception of Stamford, tend to have the largest positive gaps, or insufficient capacity to raise funds to provide adequate municipal services. Most communities in northeastern Connecticut also have positive gaps. The largest negative gaps, the report found, —representing communities with high revenue-raising capacity—are generally located in lower Fairfield County, the northwestern corner of the state, and certain communities along the shore in eastern Connecticut.

The report was coordinated for the New England Public Policy Center of the Federal Reserve Bank of Boston by Bo Zhao and Jennifer Weiner and a team of researchers. Bo Zhao is a Senior Economist in the New England Public Policy Center, specializing in public finance and urban and regional economics. Jennifer Weiner is a Senior Policy Analyst with the New England Public Policy Center. Her work focuses on state and local public finance and has included research on state business tax credits, unemployment insurance financing, state debt affordability, transportation funding, and the fiscal systems of the New England states.

uth Dakota, Wisconsin, and Minnesota, where it ranks 2nd. Anderson also ranks high in Massachusetts and Rhode Island, at #6.

uth Dakota, Wisconsin, and Minnesota, where it ranks 2nd. Anderson also ranks high in Massachusetts and Rhode Island, at #6. The #10 surname in the U.S. is Wilson, which is described as having “a checkerboard-like popularity across the United States.” In Connecticut, Wilson ranks as the 13th most popular last name.

The #10 surname in the U.S. is Wilson, which is described as having “a checkerboard-like popularity across the United States.” In Connecticut, Wilson ranks as the 13th most popular last name.

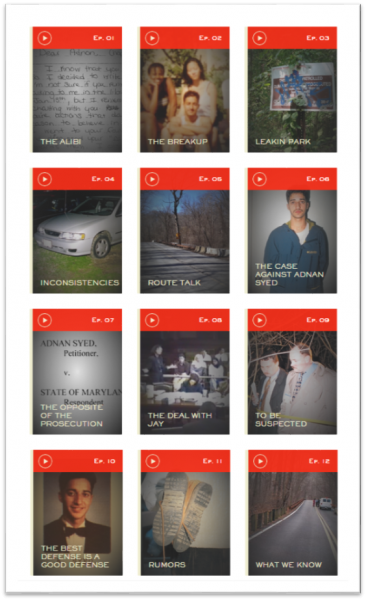

At the Law and Government Academy of Hartford Public High School, one class used Serial as the basis for a semester’s curriculum. Over the course of five months, students examined the issues in each episode of the 12-episode podcast and were asked to choose a side – such as defense counsel, prosecutor, or witness – and then advocate for their position. For their final exam, students wrote appellate court briefs and argued their cases.

At the Law and Government Academy of Hartford Public High School, one class used Serial as the basis for a semester’s curriculum. Over the course of five months, students examined the issues in each episode of the 12-episode podcast and were asked to choose a side – such as defense counsel, prosecutor, or witness – and then advocate for their position. For their final exam, students wrote appellate court briefs and argued their cases. “It’s use of new media and compelling storytelling has opened up many new opportunities for students, educators, and the intellectually curious to reexamine aspects of our legal system,” said CT Forum Executive Director Doris Sugarman. “We’re thrilled to see what is sparked when our community connects to the expression of big ideas that The Forum brings to Connecticut audiences.”

“It’s use of new media and compelling storytelling has opened up many new opportunities for students, educators, and the intellectually curious to reexamine aspects of our legal system,” said CT Forum Executive Director Doris Sugarman. “We’re thrilled to see what is sparked when our community connects to the expression of big ideas that The Forum brings to Connecticut audiences.”

Idaho recorded the largest percentage increase over the four-month period (+2.2 percent), followed by Utah (+1.8 percent). The other leading job growth states, by percentage, were Washington, Oregon, Michigan, South Carolina, Florida, Nevada, California, North Carolina, Arizona and Vermont. In West Virginia, Louisiana and Maine, average monthly employment declined slightly.

Idaho recorded the largest percentage increase over the four-month period (+2.2 percent), followed by Utah (+1.8 percent). The other leading job growth states, by percentage, were Washington, Oregon, Michigan, South Carolina, Florida, Nevada, California, North Carolina, Arizona and Vermont. In West Virginia, Louisiana and Maine, average monthly employment declined slightly. Much of how state economies are performing is due to the individual sectors making up their employment base, Governing reported, as several industries experienced weak growth to start the year. Nationally, construction and manufacturing employment expanded little over the first four months, and government employment (local, state and federal), similarly remained essentially unchanged since January, the analysis pointed out.

Much of how state economies are performing is due to the individual sectors making up their employment base, Governing reported, as several industries experienced weak growth to start the year. Nationally, construction and manufacturing employment expanded little over the first four months, and government employment (local, state and federal), similarly remained essentially unchanged since January, the analysis pointed out.

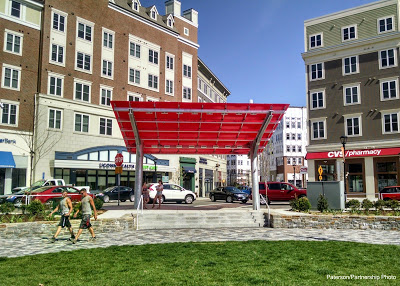

For the first time in the history of the awards program, a state agency was also selected to receive an award. The CT Department of Transportation received a special award for Starting a Revolution: Integration of Land Use and Transit in recognition of the progressive nature of CTfastrak, the bus rapid transit system opened earlier this year. The awards jury that selected the winners gave the award because they felt the new busway represents a cultural shift in how Connecticut views transit, and wanted to acknowledge the future promise of transit oriented development that will hopefully result around the station locations.

For the first time in the history of the awards program, a state agency was also selected to receive an award. The CT Department of Transportation received a special award for Starting a Revolution: Integration of Land Use and Transit in recognition of the progressive nature of CTfastrak, the bus rapid transit system opened earlier this year. The awards jury that selected the winners gave the award because they felt the new busway represents a cultural shift in how Connecticut views transit, and wanted to acknowledge the future promise of transit oriented development that will hopefully result around the station locations.

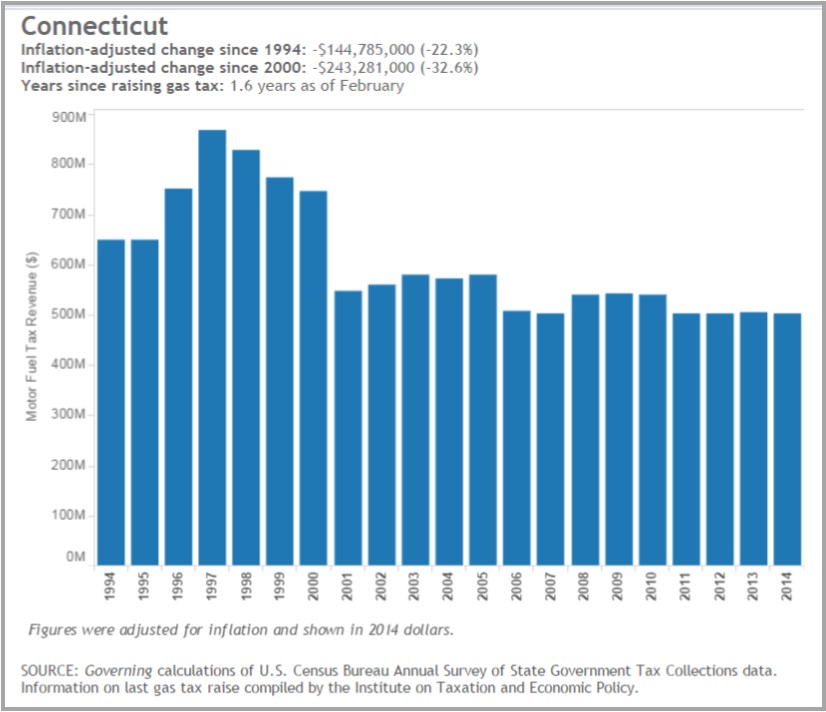

In Connecticut, the inflation-adjusted change is a reduction of in the value of the dollars provided by the tax of 32.6 percent since 2000 and 22.3 percent since 1994, according to the Governing analysis, using data from the U.S. Census Bureau and the Institute on Taxation and Economic Policy. Earlier this year, Governor Malloy announced a two-part transportation plan consisting of a

In Connecticut, the inflation-adjusted change is a reduction of in the value of the dollars provided by the tax of 32.6 percent since 2000 and 22.3 percent since 1994, according to the Governing analysis, using data from the U.S. Census Bureau and the Institute on Taxation and Economic Policy. Earlier this year, Governor Malloy announced a two-part transportation plan consisting of a

The Arbor Day Foundation also has a campus program, designating colleges and universities as a Tree Campus USA. The University of Connecticut is the only college in Connecticut to earn the designation.

The Arbor Day Foundation also has a campus program, designating colleges and universities as a Tree Campus USA. The University of Connecticut is the only college in Connecticut to earn the designation.

The global Save the Children movement currently serves over 143 million children in the US and in more than 120 countries.

The global Save the Children movement currently serves over 143 million children in the US and in more than 120 countries.