by Valerie Dugan

It used to be, when I was young, that a trip to the local mall was a real treat, with lunch at the food court and perhaps a Disney movie in the plush new cinemas. In summer we could cool off with ice cream, and before Christmas, we’d enjoy the trees and wreaths with their giant ornaments, battle the crowds, and sit on Santa’s lap for a picture in front of his castle.

These days, with the phenomena of e-commerce, giant box stores, and shopping clubs, the mall as we knew it seems to be changing. While many landmark malls around the nation are plagued by empty retail space and a significant drop in visitors and revenues, others have added attractions that continue to bring retail traffic.

E-commerce sales in the U.S. last year totaled over $341 billion, a more than 14 percent increase over the year before, and spiked in November and December for pre-holiday sales.[1] Some experts project the e-commerce space will grow to $548 billion by 2019.[2]

What will that trend mean for traditional retail? According to some analysts, over the next decade, about fifteen percent of the nation’s malls will either go bankrupt or will be converted into non-retail space, and the numbers are rising.[3] One retail consultant even predicts that in the next fifteen to twenty years, up to half of America’s shopping malls will close, especially those that house lower end to midlevel stores.[4] The ones that survive will be those that successfully adapt to changing consumer demands.

Mini-golf courses, skating rinks, gym facilities, laser tag, mazes, and even go-kart raceways are all within the spectrum of entertaining additions to malls these days.

Mini-golf courses, skating rinks, gym facilities, laser tag, mazes, and even go-kart raceways are all within the spectrum of entertaining additions to malls these days.

In Connecticut, one furniture retailer has incorporated a giant, indoor rope-climbing attraction coupled with entertainment[5]. While not in a mall, this retailer is a perfect example of the kinds of things that malls may need to do to maintain their foot traffic.

Another successful approach to damming the tide of dying malls has been the addition of grocery stores: developers bank on the philosophy that “everyone needs to buy food, so why not entice them to look at other items, too?”[6]

Some malls replace slumping anchor stores with restaurants, movie theatres and discount shops. This may be a short term fix, but if two or more anchors fail at the same time, chances are the entire mall will go out of business, researchers found.[7]

The research results further predict that the space would likely be replaced with business offices, health care facilities and community colleges.[8]

What are other nations doing? In China, futuristic new high-end malls target “smart” shoppers with technology, such as touch-screens and interactive mirrors in fitting rooms that can change lighting, reach a sales associate, or display a selection of other items of interest.[9]

At the same time, these malls-of-the-future provide consumers with “experiential” reasons to visit, reasons that cannot be found online. For instance, one mall offers a Christmas headquarters which sends out texts to guests advising them when Santa is available for a visit.[10] Once there, guests also can superimpose themselves into a selection of “selfie” videos with unique backgrounds and themes.[11]

As American malls look for anchor stores, and innovations, to attract shoppers, investors simultaneously look for interesting opportunities for their portfolios.

Open-air retail space, such as strip malls, seem to fare well because their tenants often include discount stores, grocers and drug stores – staples of every economy.[12] In fact, open-air shopping centers make up a larger proportion of the country’s total square footage for retail than do enclosed malls.[13]

And, tenant occupancy for existing properties is reportedly high as new construction decreases in a slow growth economy.[14] The dearth of supply means that landlords can push rents up.

Investors should discuss the sector with their financial advisors and consider it as part of a well-balanced portfolio. As with any other investment, of course, there may be risks involved, and each individual should evaluate based on their long term financial plan.

While visits to the malls as we remember them from childhood may be a thing of the past, the malls of the future certainly hold promise.

_________________________________

Valerie B. Dugan, CFP, is a Senior Vice President and Financial Advisor with the Global Wealth Management Division of Morgan Stanley in Hartford. For more information, please contact Valerie at 860-275-0779.

The information contained in this article is not a solicitation to purchase or sell investments. Any information presented is general in nature and not intended to provide individually tailored investment advice. The strategies and/or investments referenced may not be suitable for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives. Investing involves risks and there is always the potential of losing money when you invest. The views expressed herein are those of the author and may not necessarily reflect the views of Morgan Stanley Wealth Management, or its affiliates. Morgan Stanley Smith Barney, LLC, member SIPC.

[1] https://www.internetretailer.com/2016/02/17/us-e-commerce-grows-146-2015

[2] https://www.statista.com/topics/2443/us-ecommerce/

[3] http://www.businessinsider.com/shopping-malls-are-going-extinct-2014-1

[4] ibid

[5] http://www.jordans.com/attractions/it

[6] http://www.sandiegouniontribune.com/sdut-why-your-mall-putting-grocery-store-2012aug04-htmlstory.html

[7] http://www.businessinsider.com/shopping-malls-are-going-extinct-2014-1

[8] ibid

[9] http://www.businessinsider.com/what-the-mall-of-the-future-looks-like-2016-1

[10] http://www.businessinsider.com/what-the-mall-of-the-future-looks-like-2016-1

[11] http://www.businessinsider.com/what-the-mall-of-the-future-looks-like-2016-1

[12] http://www.wsj.com/articles/mall-reits-are-on-many-investors-shopping-lists-1457456123

[13] http://www.wsj.com/articles/mall-reits-are-on-many-investors-shopping-lists-1457456123

[14] ibid

As of June 28, 2016, there were 2,007 bakery-cafes in 46 states and in Ontario, Canada operating under the Panera Bread, Saint Louis Bread Co. or Paradise Bakery & Cafe names. Published reports indicate the company has 97,000 employees nationwide and saw a 3.4 percent growth in sales in its third quarter this year. In 2015, it reportedly generated roughly $2.7 billion in revenue. Founder and CEO Ron Shaich attended college at Clark University in Worcester in the 1970’s.

As of June 28, 2016, there were 2,007 bakery-cafes in 46 states and in Ontario, Canada operating under the Panera Bread, Saint Louis Bread Co. or Paradise Bakery & Cafe names. Published reports indicate the company has 97,000 employees nationwide and saw a 3.4 percent growth in sales in its third quarter this year. In 2015, it reportedly generated roughly $2.7 billion in revenue. Founder and CEO Ron Shaich attended college at Clark University in Worcester in the 1970’s.

Each monthly addition of New Haven Living was nearly identical to Hartford Magazine, usually with a handful of New Haven-focused articles and features added. The Courant reported that it made the decision while evaluating opportunities to invest in higher-growth areas and the cost of distribution in Greater New Haven.

Each monthly addition of New Haven Living was nearly identical to Hartford Magazine, usually with a handful of New Haven-focused articles and features added. The Courant reported that it made the decision while evaluating opportunities to invest in higher-growth areas and the cost of distribution in Greater New Haven. A limited number of promotional copies will be limited “based on a proprietary algorithm for the support of our advertisers,” Young noted. He also indicated that plans are in the works to expand the publication’s

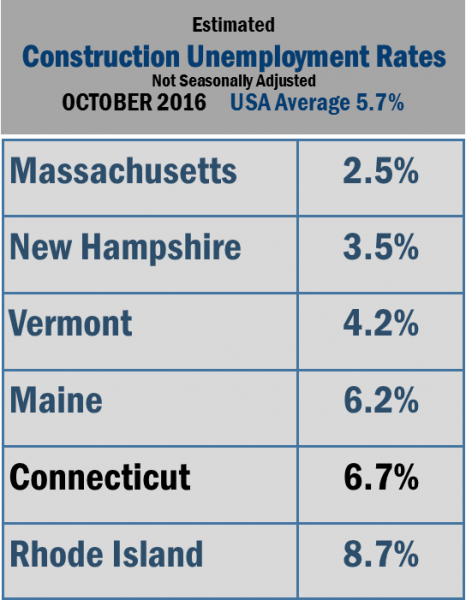

A limited number of promotional copies will be limited “based on a proprietary algorithm for the support of our advertisers,” Young noted. He also indicated that plans are in the works to expand the publication’s  The state’s construction industry unemployment rate nudged downward from 7.1 percent in September, but was 6.4 percent in July 2016. In recent years, the rate ballooned to 18.1 percent in October 2010, at the height of the recession, from a low of 5.8 percent in October of 2008.

The state’s construction industry unemployment rate nudged downward from 7.1 percent in September, but was 6.4 percent in July 2016. In recent years, the rate ballooned to 18.1 percent in October 2010, at the height of the recession, from a low of 5.8 percent in October of 2008.

arch done

arch done

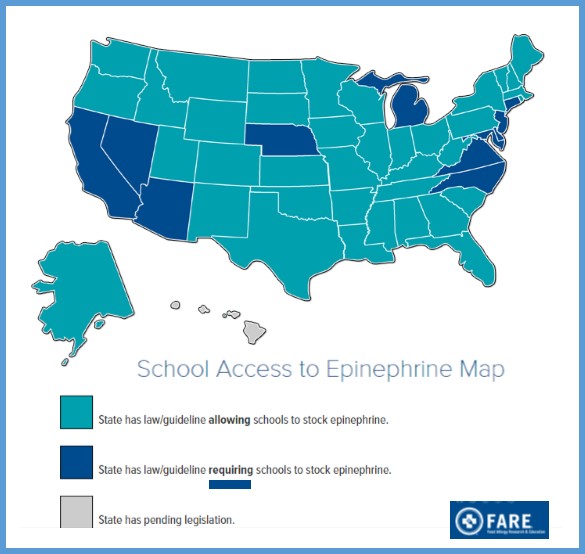

In 2015 the legislature considered, but did not pass, a bill requiring the insurance commissioner to study and report on health insurance coverage of and out-of-pocket expenses for EpiPens, according to the OLR report. The 2014 legislation requires (a) schools to designate and train nonmedical staff to administer EpiPens to students having allergic reactions who were not previously known to have serious allergies and (b) the public health and education departments to jointly develop an annual training program for emergency EpiPen administration.

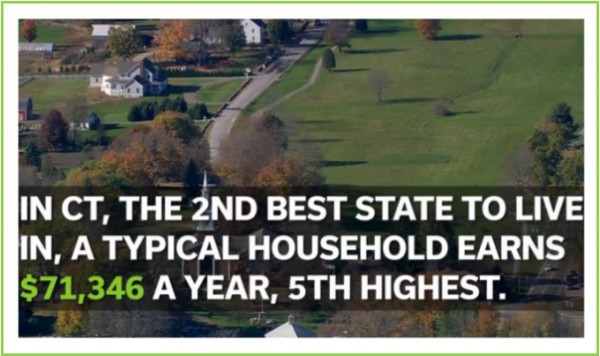

In 2015 the legislature considered, but did not pass, a bill requiring the insurance commissioner to study and report on health insurance coverage of and out-of-pocket expenses for EpiPens, according to the OLR report. The 2014 legislation requires (a) schools to designate and train nonmedical staff to administer EpiPens to students having allergic reactions who were not previously known to have serious allergies and (b) the public health and education departments to jointly develop an annual training program for emergency EpiPen administration. Quality of life in the United States is heavily dependent on financial status, the survey summary points out. As a consequence, the nation’s best states to live in often report very high incomes. With a median household income of $71,346 a year, fifth highest of all states, Connecticut is the second

Quality of life in the United States is heavily dependent on financial status, the survey summary points out. As a consequence, the nation’s best states to live in often report very high incomes. With a median household income of $71,346 a year, fifth highest of all states, Connecticut is the second

In a reversal from the previous quarter, 42 percent of state residents surveyed said they were unlikely to move out of state in the next 5 years, compared with 34 percent who described such a move as likely. In the previous survey, conducted in the second quarter of this year, the numbers were reversed with 42 percent saying that it was likely they’d be moving out of state within five years, compared with only 32 percent who said such a move was unlikely.

In a reversal from the previous quarter, 42 percent of state residents surveyed said they were unlikely to move out of state in the next 5 years, compared with 34 percent who described such a move as likely. In the previous survey, conducted in the second quarter of this year, the numbers were reversed with 42 percent saying that it was likely they’d be moving out of state within five years, compared with only 32 percent who said such a move was unlikely. Residents of Windham and Fairfield counties were more likely to view overall business conditions as being better now than six months ago, the survey found. Twenty-nine percent of Windham residents held that view as did 28 percent of Fairfield residents. Residents of the state’s other six counties, Middlesex (23%), New London (20%), New Haven (20%), Litchfield (16%), Tolland (16%) and Hartford (16%) had fewer residents expressing that opinion.

Residents of Windham and Fairfield counties were more likely to view overall business conditions as being better now than six months ago, the survey found. Twenty-nine percent of Windham residents held that view as did 28 percent of Fairfield residents. Residents of the state’s other six counties, Middlesex (23%), New London (20%), New Haven (20%), Litchfield (16%), Tolland (16%) and Hartford (16%) had fewer residents expressing that opinion.

Louise DiCocco, Assistant Counsel for the Connecticut Business & Industry Association, noted that “24 years ago, more than 80 percent of Connecticut votes overwhelmingly approved a spending cap to keep the cost of state government within the taxpayers’ means to afford it. Voters demanded the cap as an offset to the persona income tax in Connecticut. The state must enact a spending cap that is ironclad and works.”

Louise DiCocco, Assistant Counsel for the Connecticut Business & Industry Association, noted that “24 years ago, more than 80 percent of Connecticut votes overwhelmingly approved a spending cap to keep the cost of state government within the taxpayers’ means to afford it. Voters demanded the cap as an offset to the persona income tax in Connecticut. The state must enact a spending cap that is ironclad and works.” State Senator Toni Boucher of Danbury told the Commission: “I hope that the commission to adopt a definition of general budget expenditures that is comprehensive and gives a complete and realistic account of all the money that the state spends… it is equally critical that the legislature not be allowed to move what was once an expenditure included under the cap to bonding or fund it with a revenue intercept for the purpose of undermining the cap’s integrity.”

State Senator Toni Boucher of Danbury told the Commission: “I hope that the commission to adopt a definition of general budget expenditures that is comprehensive and gives a complete and realistic account of all the money that the state spends… it is equally critical that the legislature not be allowed to move what was once an expenditure included under the cap to bonding or fund it with a revenue intercept for the purpose of undermining the cap’s integrity.”

cal Centers is a joint venture between two leading health care organizations – GuideWell Mutual Holding Company and Organización Sanitas Internacional. GuideWell is a U.S.-based not-for-profit mutual holding company and the parent to a family of forward-thinking companies focused on transforming healthcare.

cal Centers is a joint venture between two leading health care organizations – GuideWell Mutual Holding Company and Organización Sanitas Internacional. GuideWell is a U.S.-based not-for-profit mutual holding company and the parent to a family of forward-thinking companies focused on transforming healthcare. Mini-golf courses, skating rinks, gym facilities, laser tag, mazes, and even go-kart raceways are all within the spectrum of entertaining additions to malls these days.

Mini-golf courses, skating rinks, gym facilities, laser tag, mazes, and even go-kart raceways are all within the spectrum of entertaining additions to malls these days.