During the summer, progress was made on efforts to advance social benefit corporations – businesses that aim to impact their communities in addition to making a profit – but that progress did not come in Connecticut.

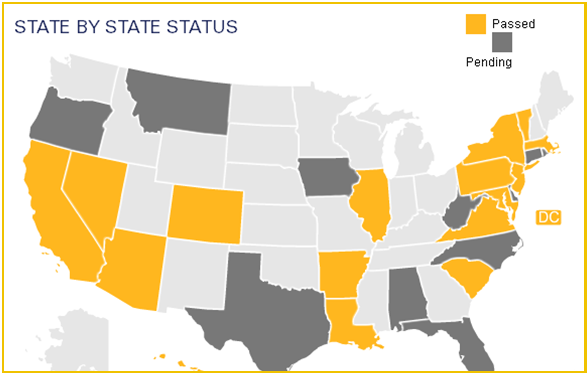

Delaware became the 19th state (plus the District of Columbia) to enact benefit corporation legislation in July. Similar legislation did not make it through the Connecticut legislature in 2013, despite widespread support and no known opposition.

Delaware, as corporate home venture-backed businesses, 50 percent of all publicly-traded companies, and 64 percent of the Fortune 500, is considered by advocates to be among the most important states for businesses that seek access to venture capital, private equity, and public capital markets.

The goal of the legislation is to create in state law a new type of corporation—the benefit corporation—that best meets the needs of entrepreneurs a nd investors seeking to use business to solve social and environmental problems. Benefit corporations operate the same as traditional corporations but with higher standards of corporate purpose, accountability, and transparency, advocates say. The new designation provides business leaders with legal protection to pursue a higher purpose than profit, and they offer investors and the public greater transparency to protect against pretenders, supporters point out.

nd investors seeking to use business to solve social and environmental problems. Benefit corporations operate the same as traditional corporations but with higher standards of corporate purpose, accountability, and transparency, advocates say. The new designation provides business leaders with legal protection to pursue a higher purpose than profit, and they offer investors and the public greater transparency to protect against pretenders, supporters point out.

In Connecticut, despite being introduced earlier this year with the backing of Governor Dannel Malloy, overwhelming support in the state House where it passed by a lopsided 128-12 on May 20, and co-sponsorship by the legislature’s four top leaders, legislation establishing the “benefit corporation” as a new type of corporate entity never came up for a vote in the State Senate, and thus it died when the session ended in June.

Among the leading advocates of the proposal in Connecticut, the reSET Social Enterprise Trust has vowed to renew the effort next year, a commitment echoed by a broad coalition of supporters in the private sector and in government economic development circles. “In the next legislative session, reSET will re-double its efforts to secure passage of t his much-needed legislation,” the organization emphasizes, pointing out that the bill “drafted in cooperation with the Connecticut Bar Association and BLab, is the most comprehensive of its type proposed in the United States.”

his much-needed legislation,” the organization emphasizes, pointing out that the bill “drafted in cooperation with the Connecticut Bar Association and BLab, is the most comprehensive of its type proposed in the United States.”

In recognition of the milestone achievement in Delaware, more than 600 businesses around the country signed an Open Letter inviting their peers to join the movement to redefine success in business.

The letter stated, in part, “we see this as a big market opportunity, because a large and increasing number of people want to support a better way to do business -- better for our workers, better for our communities, better for our environment. Until recently, corporate law has not recognized the legitimacy of any corporate purpose other than maximizing profits. That old conception of the role of business in society is at best limiting, and at worst destructive. By serving a higher purpose and by meeting higher standards of transparency and accountability, we build our most important asset -- trust. This trust enables us to attract the best talent and turn customers into evangelists, helping us make money and make a difference.

Delaware Governor Jack Markell, writing in the Huffington Post, said “These new Delaware public benefit corporations will harness the power of private enterprise to create public benefit. In the short term, they will create high quality jobs and improve the quality of life in our communities. In the long term, as many enter the public capital markets, they will help combat the plague of short termism that we have seen over the last five years can undermine a shared and durable prosperity.”

Markell noted that the new public benefit corporations will “have three unique features that make them potential game changers” – “concern corporate purpose, accountability, and transparency.” Prior to serving in government, Markell, now in his second term as Governor, was senior Vice President for Corporate Development for Nextel, having been one of the first fifteen people hired by the company.

Among those advocating for benefit corporation legislation across the country – including Connecticut - is the nonprofit organization behind the Certified B Corporation designation. B Lab is a 501(c)3 nonprofit that serves a global movement of entrepreneurs using the power of business to solve social and environmental problems. B Lab serves these entrepreneurs through three interrelated initiatives that provide them the legal infrastructure and help them attract the customers, talent, and capital to scale.

Benefit Corporations and Certified B Corporations are distinct terms. They share much in common and have a few important differences. Certified B Corporation is a certification conferred by the nonprofit B Lab. Benefit corporation is a legal status administered by a state government, such as the case this summer in Delaware (and almost in Connecticut). Benefit corporations do NOT need to be certified.

Certified B Corporations have been certified as having met a high standard of overall social and environmental performance, and as a result have access to a portfolio of services and support from B Lab that benefit corporations do not. The B Lab website indicates more than 800 companies in 27 countries and 60 industries have earned the designation.

are Month (National Association for Home Care & Hospice) and National Hospice Month (National Hospice and Palliative Care Organization), as well as Great American Smokeout Month. November 21 is designated by the American Cancer Society as the Great American Smokeout Day.

are Month (National Association for Home Care & Hospice) and National Hospice Month (National Hospice and Palliative Care Organization), as well as Great American Smokeout Month. November 21 is designated by the American Cancer Society as the Great American Smokeout Day.